Understanding and Improving Your Credit Score

Learn how to understand and improve your credit score with practical tips and strategies for better financial health.

What is a Credit Score?

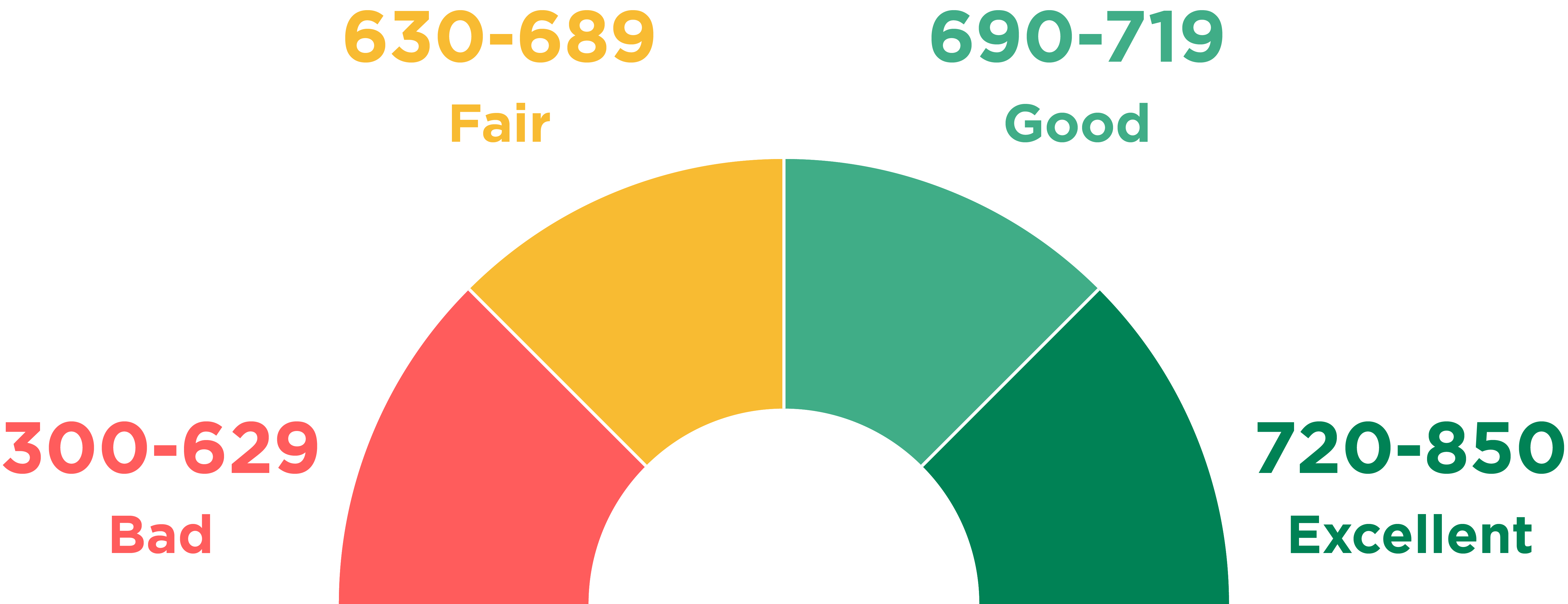

A credit score is a numerical representation of your creditworthiness, calculated based on your credit history. It is a critical factor that lenders use to assess the risk of lending you money. The score typically ranges from 300 to 850, with higher scores indicating better creditworthiness. Various factors contribute to your credit score, including your payment history, the amount of debt you owe, the length of your credit history, and the types of credit you have. Understanding these elements is the first step in improving your credit score and ensuring you have access to favorable lending terms.

Factors Influencing Your Credit Score

Several key factors influence your credit score. Payment history is the most significant, accounting for about 35% of your score. Consistently making on-time payments can positively impact your score. The amount of debt you owe is another crucial factor, representing around 30% of your score. High levels of debt can lower your score, so it is essential to manage and reduce your debt levels. Other factors include the length of your credit history (15%), new credit inquiries (10%), and the types of credit you use (10%). Each of these elements plays a role in determining your overall credit score.

Checking Your Credit Report

Regularly checking your credit report is essential for maintaining a good credit score. Your credit report contains detailed information about your credit history, including your payment history, outstanding debts, and recent credit inquiries. By reviewing your credit report, you can identify any errors or inaccuracies that may be negatively impacting your score. If you find any discrepancies, you should report them to the credit bureaus immediately for correction. Additionally, monitoring your credit report can help you detect any signs of identity theft or fraudulent activity early on, allowing you to take action to protect your credit.

Improving Your Payment History

Improving your payment history is one of the most effective ways to boost your credit score. Start by ensuring that you pay all your bills on time, every time. Setting up automatic payments or reminders can help you stay on track. If you have missed payments in the past, work on bringing your accounts current and maintaining a consistent payment record moving forward. Additionally, if you are struggling to manage your payments, consider reaching out to your creditors to discuss possible payment plans or arrangements. Demonstrating a commitment to paying your debts on time can significantly improve your credit score over time.

Managing and Reducing Debt

Effectively managing and reducing your debt is crucial for improving your credit score. Begin by creating a budget to track your income and expenses, allowing you to identify areas where you can cut costs and allocate more funds towards paying down your debt. Focus on paying off high-interest debts first, as these can quickly accumulate and negatively impact your score. Additionally, avoid taking on new debt while you are working to pay off existing balances. By consistently reducing your debt levels and maintaining low balances, you can improve your credit utilization ratio, which is a key factor in determining your credit score.

Building a Long-Term Credit Strategy

Building a long-term credit strategy is essential for maintaining a healthy credit score. Start by keeping older credit accounts open, as the length of your credit history positively impacts your score. Diversify your credit mix by having a combination of credit types, such as credit cards, installment loans, and mortgages. Avoid opening too many new accounts in a short period, as this can lower your score. Additionally, practice responsible credit behavior by using credit wisely and making informed financial decisions. By developing and adhering to a long-term credit strategy, you can ensure sustained improvements to your credit score and overall financial health.